Proposition C: Public Safety Tax Rate Election

Proposition C: Public Safety Tax Rate Election

City Council has ordered a proposition to be placed on the ballot in the November 2024 General Election for Cibolo voters to decide whether to raise the tax rate above the Voter Approval Tax Rate (VATR) of $0.4769 to $0.4990, which would generate roughly $780,000.

Proposition C is a proposal to adjust the city's tax rate to fund increased compensation for uniformed public safety employees (Police and Fire) and hire one additional firefighter. If passed, this would raise compensation for public safety employees to be competitive with cities in the surrounding area and provide recurring revenue for these changes going forward.

Due to increased competition in the region, the City has faced recruitment and retention challenges, making this funding critical for attracting and retaining public safety personnel. If voters do not approve the tax increase in November, the $780,000 allocated for the compensation adjustment and the 1 new firefighter will be removed from the budget resulting in police and fire uniformed personnel not being compensated competitively,

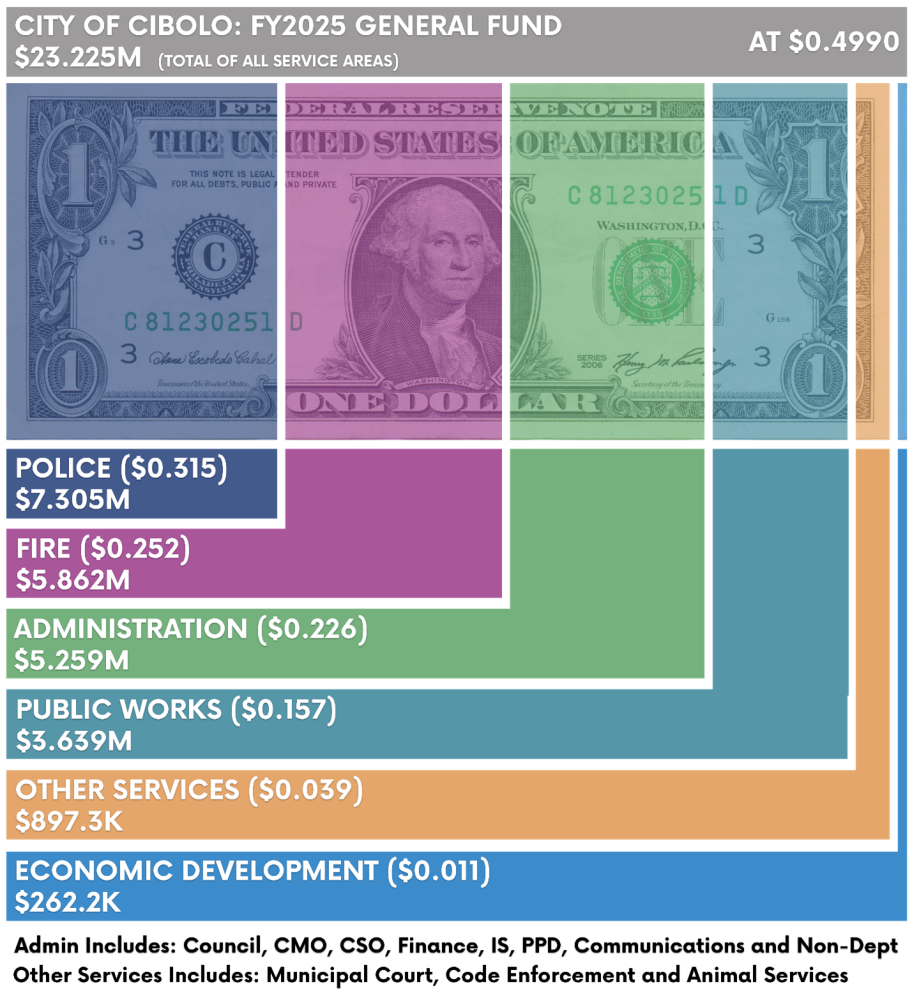

Where do your Tax Dollars Go?

Police and fire are funded from the General Fund, which is projected to have $23.225 million in expenses in Fiscal Year 2025. Our Police and Fire account for 56.7¢ of every dollar.

Workforce Full Time Employees (Funded)*

• Total Funded FTEs = 199

• Police FTEs = 43 police officers; 52.4 total FTEs

• Fire FTEs = 36 firefighters; 39 total FTEs

• Police and Fire represent 40.20% of all FTEs in the General Fund

• City allocates $11.728 Million or 50% of all General Fund expenditures to provide public safety

*Does not include the additional firefighter

GO VOTE!

What is a tax rate election? This tax rate election for the City of Cibolo is aimed at seeking approval from residents to change the tax rate that directly impacts the city's revenue and financial operations for Police and Fire.

Why is a tax rate election important? This tax rate election will give the residents the opportunity to directly influence how their local government generates revenue and allocates funds for essential services such as Police and Fire. Remember that a tax rate election plays a crucial role in shaping Cibolo’s future. Stay informed, participate actively, and exercise your right to vote in this election.

GO VOTE!

What is a tax rate election? This tax rate election for the City of Cibolo is aimed at seeking approval from residents to change the tax rate that directly impacts the city's revenue and financial operations for Police and Fire.

Why is a tax rate election important? This tax rate election will give the residents the opportunity to directly influence how their local government generates revenue and allocates funds for essential services such as Police and Fire. Remember that a tax rate election plays a crucial role in shaping Cibolo’s future. Stay informed, participate actively, and exercise your right to vote in this election.