King County C-PACER Program

King County C-PACER Program

King County is developing a Commercial Property Assessed Clean Energy + Resiliency (C-PACER) program, an innovative financing mechanism to help commercial, industrial, agricultural and multi-family buildings become more efficient and resilient.

King County C-PACER Program

A financing tool for more efficient, resilient commercial and multi-family properties in King County

Program introduction

King County is developing a Commercial Property Assessed Clean Energy Resiliency (C-PACER) program, an innovative financing mechanism to help commercial, industrial, agricultural and multi-family buildings become more efficient and resilient.

Throughout the program development process, King County will seek input from a broad range of stakeholders to learn how the program can best serve the community and to increase awareness around the program before it launches later in 2021.

PACE resources from local and national organizations:

- United States Department of Energy: https://www.energy.gov/eere/slsc/property-assessed-clean-energy-programs

- Shift Zero: https://shiftzero.org/pace/

- PACENation: https://pacenation.org/

Draft King County C-PACER Program materials

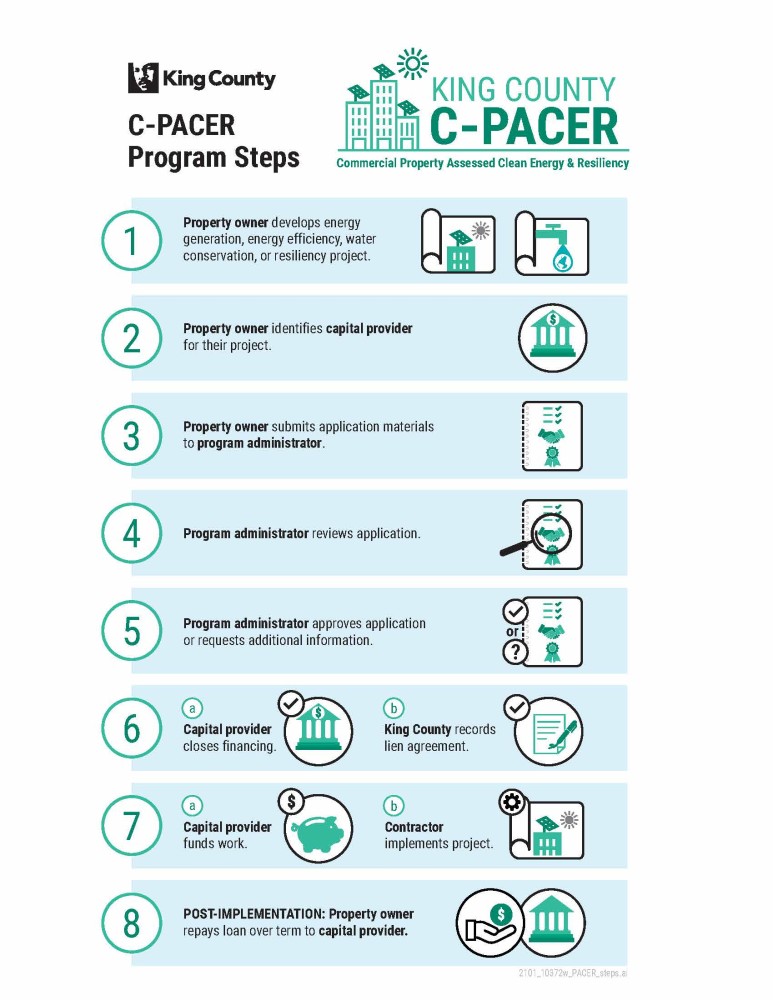

How a C-PACER Program works

Property assessed clean energy and resiliency programs allow property owners to finance energy and resiliency projects, paying the costs back through a voluntary assessment. This is different from traditional loans because the assessment is attached to the property rather than the individual, meaning that if the property owner sells the building, the assessment stays with the building (unless payoff is part of the sale agreement).

Examples of projects that can be financed using C-PACER include:

Energy and water efficiency

- Renewable energy

- Seismic hardening

- Fire protection

- Flood readiness

- Energy storage

Benefits of C-PACER financing

Property owners can save money by lowering utility bills and energy costs.

Longer loan terms payback terms can make PACE-funded projects cash-positive sooner than traditional loans. In addition, PACE loans seldom require cash upfront, making them more accessible to property owners.

Lower interest rates on PACE financing makes loans more affordable.

Creates local jobs and spurs economic activity though the funding of new efficiency and resiliency projects.

Developing the King County C-PACER Program

In 2020, Washington State passed HB 2405 authorizing counties to establish C-PACER financing programs. In response to the state legislation, the Executive-proposed 2020 Strategic Climate Action Plan committed to proposing a C-PACER program for King County.

Later this year the County will propose an ordinance to set up this C-PACER program, but first we want to hear from you!

Share your thoughts!

We want to hear from you about what you want to see from this type of program.